I was a good kid, I used to do my homework, I ate everything my parents give me and I didn’t break too many things, so my parents give me a bike. I spent hours and hours on it with a boundless thrill. I only had dreams about the disappearance of those two small lateral wheels that stabilize the bike; they showed my inexperience.

My grandfather decided to teach me. He took the “orthopedic” wheels out and we went to the street. In a broad sidewalk from an avenue, he -with infinity patience- hold the seat while I was pedaling. My instinct made me look at the potholes and obstacles in the pavement closer to the front wheel, so I could try to avoid it. Nevertheless, he told me “look forward, look far away” with the same persistence as I disobey him.

Tired of my procedure, he stops the bike suddenly and told me in a serious tone that either I paid attention to him, or he would stop teaching me. Only with the though of the embarrassment of having to need again lateral wheels, I decided – against my own logics – to obey him.

After two minutes I heard his voice far away: “ You are doing it very well!”. I had learnt.

Traditional metrics

Retailing is an activity where, as you can get an immediate feedback to the decisions you make (for example, you only will need little time to observe if a certain product presentation works or not) the risk is to practice this profession looking only to the front wheel, in a short sightedness way.

Probably one of the most common metrics in retailing, no matter what the sector or country, is the average ticket value; the average amount of the transactions. I had been working with retail for more than three decades and still today I haven’t found any executive that doesn’t know this indicator by heart.

Of course, everybody also know the period sales, the turnover relative to the same period from the previous year, and the deviation from the budget.

All these indicators have the advantage that there are very easy to obtain and use. But, they have a disadvantage: they show the business as a sequence of pictures, instead of dynamically, as a film.

Most of the retail companies (e.g.: a supermarket, a bank, a hairdresser, a cafeteria, a boutique, an online store, or an airline, etc.) don’t look for a person that only comes and buys once, but for a person who becomes a regular customer or even a fan.

And traditional metrics doesn’t have this long term approach in their DNA.

In the long term

If a customer’ who spends every week 50 € in our shop, gets angry and doesn’t come back again because we haven’t attended his/her properly, the so called common sense tells us that we lose much more than 50 €. However, How many times we have seen or suffered that myopic management strategy, claiming that a customer wasn’t right with his/her complain!

Attending a complain – fertilizing the customer – is similar to a bank that invest giving a credit, with the hope that they will obtain a benefit from it due to the following regular returns. To calculate it there is a formula, the Net Present Value (NPV), that you could find prefabricated in regular spreadsheet templates.

Kotler (1974:24) defined the probability of having a customer in the long term as the present value of the future expected benefit along a temporal horizon of transactions with a given customer.

The value of a customer in the long term

The “value of a customer in the long term” (Customer Lifetime Value, CLTV) is a formula focused on knowing how much each customer is worth, in euros or in any currency.

The CLTV is a way to measure the present value from the future cash flow attributed to each customer purchasing pattern. It allows you to know how much money a customer’ could achieve to provide in the future, if he/she remains with the same shopping patterns as up to now.

The first time that the term Customer Lifetime Value appeared in a publication was in Shaw & Stone book “Database Marketing” published in 1988, that includes multiple examples.

It could be used at one customer level, but also at a specific customer’ segment level; for example the ones with more price sensibility, more time sensitive, or ones who go to the mall shops, etc.

Obviously there is a need for retail companies to know shopping behavior at individual customer’ level. It is one of the main aims of the “loyalty cards”. Besides it is not need to have a plastic card, but any kind of method to identify what a customer’ does.

The main advantage of CLTV in front of traditional metrics is that it allows us to obtain a long term view of the relationship between the customer and the company, and in this way be able to make strategic decisions.

| Traditional metrics | CLTV | |

| Characteristics | It is like a static picture from a specific moment. Short term vision. |

It has prospective pretensions. Long term vision of the activity and commercial relation. |

| Functions | Detects the current results evaluating customers through its current behaviour. | Value customers through how much they will give, taking into account attraction and retention costs. |

| Usage | Useful in the operational decision making that needs to be done quickly. Easy to understand by everybody from the company. |

Useful in planning decision making in the long term. Also used to decide either to invest occasionally in a customer or not. |

| Scope | Usually are aggregated data. | It could be used in aggregated way, but is ideal at individual customer level. |

Thomas, Reinartz & Kumar (2004) analyzed the behavior of a group of customers’ during 3 years. They observed that the bigger segment was the one with the most easy to acquire and retain customers’. Those represented the 32% of the total amount of customers, but only gave the 20% of the benefits. On he other hand, the 40% of the benefits came from the 15% of the customers’, the smallest group, hard and difficult to capture, but easy to retain if you give them what they need.

Who wants to apply that metric could make a simulation at this Harvard B. S. web page.

The whole formula can be downloaded in a spreadsheet format at this Harvard B. S. web page done with the collaboration of Microsoft.

Implications

I haven’t met yet any company in retailing who says that it is not or would’t be customer-centered. However, in practice it seems to me that most of them knows more about product category than about customers. Most of them have executives responsible for managing the different product categories or chains, but I have seen very few that have “customer managers”.

The philosophy behind this metric is double:

- As the company life off customers, they have to be the center. So they have to be understood, observed and measured.

- Economic sustainability doesn’t come from a “buck”, neither from promotional pressure, but making customers to come back. So, metrics that takes into account such dynamic approach in a long term, have to be used.

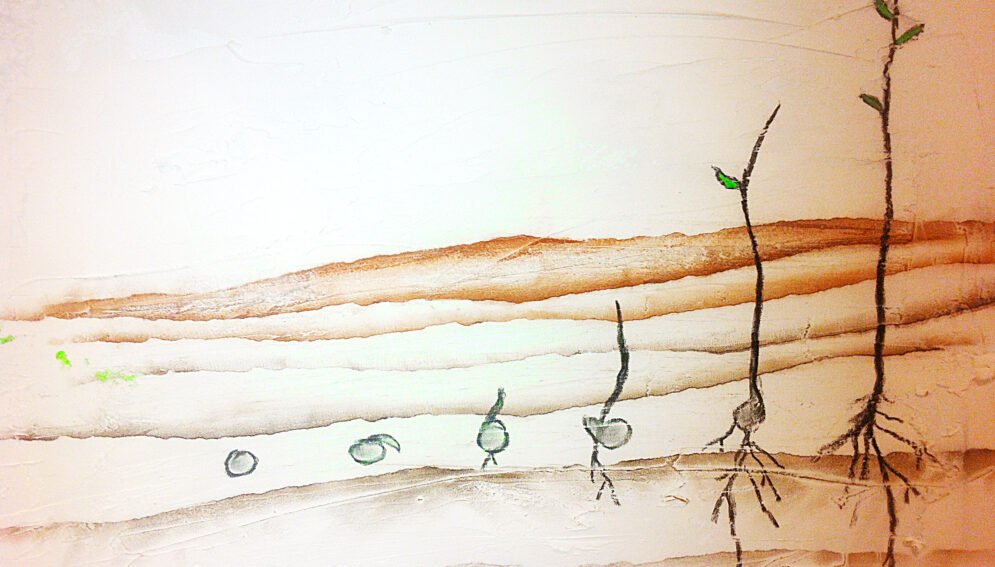

Companies in retail (also most of the other) have to see themselves as “customer farmers”, as “growers” not of pears but of customers.

A new customer is a seed to take care of, that it gets seeded (attraction costs) is irrigated and fertilized (maintenance costs), with the intention to bear fruits (what they buy, the quantity, the frequency and the margin).

If retail companies sees themselves as “customers growers” most of the interdepartmental conflicts will disappear, and the most important: customers will feel more empathy from the retail chain than they get from a 3×2 promotion.

Bibliography

Kotler, P, (1974), Marketing during periods of shortage” Journal of Marketing, Vol. 38, Issue. Summer, pp 20-29.

Shaw, R. and M. Stone (1988). Database marketing, Gower, London.

Thomas, J. S.; Reinartz, W.; & Kumar, V. (2004) Getting the most out of all your customers. Harvard Business Review, Vol. 82, Num. 8, pp: 116 – 123.

_____________

Lluis Martinez-Ribes

Source: Código 84, nº 173.